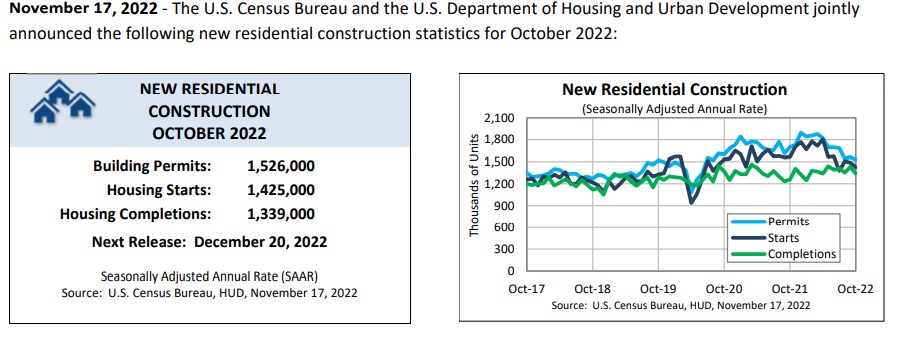

New home construction also continued to drop as builders deal with a retreat in housing demand. Residential housing starts decreased 4.2% in October to a 1.43 million annualized rate, according to government statistics. Single-family homes started for construction dropped to an annualized 855,000 rate, the lowest since May 2020.

As mortgage rates rise and inflation remains stubborn, there are signs that the housing market is slowing down

Real estate brokerage Redfin predicts that housing sales will sink to their lowest level since 2011

Elevated prices and inadequate build rates will likely prop up prices, preventing a massive wave of foreclosures

In the past year, rising inflation and soaring interest rates have spilled into the turbulent housing market.

Just a year ago, mortgage rates set near record lows as home prices soared. Now, interest rates near 7%, while home prices have jumped nearly 40% since March 2022.

Spiking mortgage rates make a difference

As the federal funds rate has soared, mortgage rates have moved up, too. (In some cases, before Fed rate hikes actually took effect.)

In early December, 30-year mortgage rates averaged nearly 6.5% – over double January 2021’s average rate. While far below the 18% rates seen in the 1980s, it’s still been nearly 15 years since average rates have exceeded 15%.

Even when home prices remain stagnant, the impact of such high rates is astronomical.

Consider a $300,000, 30-year fixed-rate loan (excluding taxes and interest).

At 6.5% interest, your monthly payment comes out to just under $1,900. Over 30 years, you’ll pay nearly $683,000. In other words, you’ll pay more in interest than your home itself was originally worth.

But at 3% interest, your monthly payment comes out near $1,265 per month, or just over $455,330 over 30 years. At such low rates, you’ll only pay half your home’s initial value in interest.

Housing Market Forecast 2022 to 2023

According to the latest report published by Fortune, in October Moody’s Analytics once again lowered its national home price outlook. Peak-to-trough, Zandi expects U.S. home prices to fall 10%. If a recession does manifest, that housing market prediction shifts down to a 20% peak-to-trough decline. Through spring 2023, he expects mortgage rates to hover around 6.5%.

Back in May, Moody’s Analytics chief economist Mark Zandi told Fortune that the Federal Reserve’s inflation fight would see the U.S. housing market slip into a “housing correction.” At the time, he expected home prices to flatline nationally and fall between 5% to 10% in “significantly overvalued” markets. In October, the firm clearly lowered its outlook.

The housing forecast varies regionally, though. 322 regional housing markets were analyzed. Of those, the firm predicts that 49 housing markets to see home prices fall over 15%. The firm predicts a 24.1% drop in property prices in Morristown, Tenn., and a 23.3% drop in Muskegon, Mich. Housing markets such as New York and Chicago will see a decline of 6.3% and 4.2%, respectively, from peak to trough. They expect “significantly overvalued” housing markets like Boise, Flagstaff, Seattle, and San Francisco to see the sharpest declines in home prices.

As housing demand continues to decelerate and both buyers and sellers attempt to regain their footing, it is important to remember that the surge in housing demand in 2021 was fueled by unusual circumstances, such as COVID-19-induced demand for more space and vacation homes, as well as record-low mortgage rates.

The positive outlook is that the firm does not predict a financial or foreclosure crisis on the scale of 2008, but they do expect housing fundamentals to return to the mean. Some of that moderation will be brought about by growing salaries, while some will be brought about by declining home prices. The housing market won’t be overvalued after this correction is over.

The latest from Zillow is that it predicts that the final months of 2022 will not bring about significant increases in home values, even though it forecasts that home values will increase in the majority of markets between October 2022 and October 2023. As a result of rising mortgage rates, the value of homes in around two-thirds of the nation’s main housing markets declined throughout this past summer.

The economic jolt caused by rising mortgage rates is continuing to eat away at some of the gains that were earned in the spring of 2022. Zillow projects typical U.S. home values to fall 0.6% from October 2022 to January 2023, before recovering and posting 0.8% growth by the end of October 2023. The national Zillow Home Value Index, which rose 11.9% in the 12 months ending in October 2022, is expected to grow by just 0.8% over the next 12 months.

This long-term outlook is slightly lower than last month’s call for a 1.2% annual increase. This downward revision is due in large part to expectations for more declines in home sales volume in the coming months. A weaker home sales forecast translates to more inventory, and therefore a faster correction in home values, leading to a downward revision.

Zillow’s forecast for existing home sales in 2022 was revised down slightly as leading indicators point to a continued slowing in the housing market in the near term. Expectations for continued weakness in home sales volume led Zillow’s one-year home value forecast to be revised downward in November.

The real estate group expects 5.1 million existing homes to be sold in the calendar year 2022 – a 16% decrease compared to 2021. This is down slightly from September’s forecast of 5.2 million. High mortgage rates and major affordability challenges are predicted to drive weaker sales in 2023. As mortgage rates reached 20-year highs in October, it is making monthly payments unaffordable for new buyers. As buyers and sellers are stepping away from the market, home prices are likely to remain stable.

Goldman Sachs analysts published a study titled “The Housing Downturn: Further to Fall” on August 30. The investment bank now predicts that activity in the US housing market will be down by the end of 2022. This year, the business predicts steep reductions in new home sales (22%), existing home sales (17%), and housing GDP (8.9%). Goldman Sachs projects further declines in 2023 in new home sales (another 8% drop), existing home sales (another 14% drop), and housing GDP (another 9.2% drop).